What’s Wall Street Saying About the Steel Industry?

The steel industry

The metals sector has seen significant downgrade activity this year. Most of these downgrades have come after the 4Q15 earnings release. Although most steel companies reported better-than-expected earnings, analysts seem concerned about the industry’s near-term outlook. Earlier this year, we looked at the possibility of analyst downgrades in the steel industry.

Series overview

It’s important to note that analyst estimates generally lag price movements. We see upgrades coming when stocks have already run up. As for downgrades, they come when the company has already seen downward price action. Having said that, changes in analyst estimates are a key driver of short-term price movements. Investors should keep track of changes in analyst estimates, as they provide insights into what the markets are expecting from the company.

In this series, we’ll look at analyst recommendations for steel companies. And we’ll see what Wall Street thinks about US (VOO) steel companies.

4Q15 earnings season

The 4Q15 earnings season is nearly over. Most steel companies reported better-than-expected earnings. You can look at the key highlights of the 4Q15 earnings season in our series Looking Back to Push Forward: Decoding 4Q15 Steel Earnings in 2016.

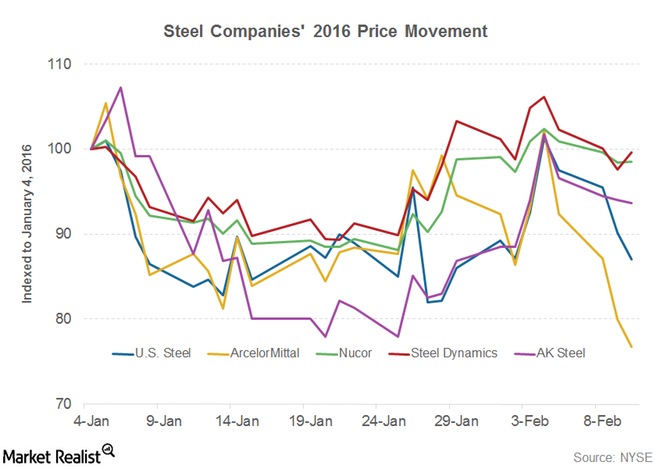

Looking at the price actions post earnings release, Nucor (NUE), Steel Dynamics (STLD), and AK Steel (AKS) saw upward price actions after their respective 4Q15 earnings releases. However, ArcelorMittal (MT) and United States Steel (X) saw heavy selling pressure after their earnings release. The above graph shows steel companies’ recent price movements.