We are worried, but confident

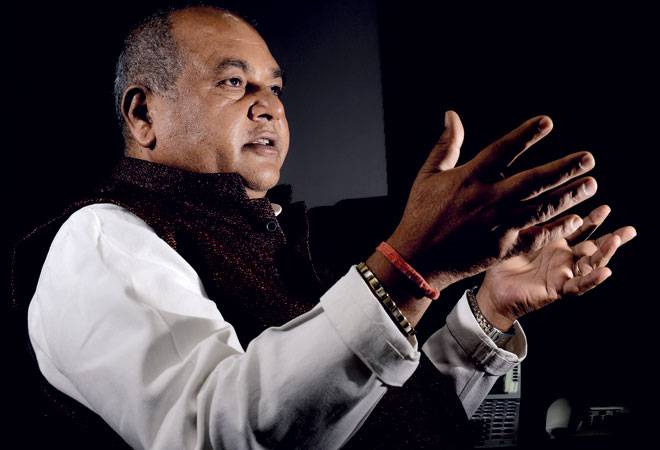

A dramatic surge in import of steel from China, Japan and Korea has battered the domestic steel industry. Numerous policy interventions have not helped. Union Steel and Mines Minister Narendra Singh Tomar tells BT's Rajeev Dubey and Sumant Banerji that while the government is considering more measures to restrict imports, the sector may remain under stress for some more time. Edited excerpts:

BT: How severe is the distress in the domestic steel industry?

Tomar: This sector is deregulated and keeps fluctuating as per the overall market. It is true that there are lots of problems right now and we are aware of it. Industry is also trying to wriggle out of it. After a long time there is stress in this sector. The impact of this is on everything.

BT: How do you plan to tackle the surge in import of steel?

Tomar: We imposed safeguard duty, increased anti-dumping and import duty, and our intention is to improve the situation. But even after that there is lot of stress. Industry has been arguing for more protection. When the right time comes, we will look into the merit of those arguments because protecting the interests of the steel industry is without doubt a priority for us. This sector brings in a lot of investments, there is a lot of exposure of banks, and it is also a big employment generator, providing direct employment to seven lakh people and indirectly 35 lakh people are affected by it. It also contributes two per cent to GDP. We are worried but confident that we will sail through this time of crisis.

BT: There are reports that China is selling steel at prices lower than production cost. How do you manage that?

Tomar: China's dumping is a major concern and they are selling at a cost lower than their own production cost. It may be their strategy, but without doubt it is damaging us. We are considering how best we can protect the domestic industry from getting impacted by this dumping. I have met the FM (Arun Jaitley) as also (commerce minister) Nirmala Sitharaman over this issue and discussed it at length. Principally, everybody is agreeable to protecting the domestic industry, but at the same time, the forward course of action will depend on the merit of laws, customs, procedures and arguments, and representation by the industry as per the laid-down procedure substantiated with data and statistics. In today's scenario, imports from China, Japan and Korea are hurting us. We have FTAs with Japan and Korea, but we cannot go back and undo that and have to honour our commitment. At the same time, we have to look for a way out.

BT: Has there been any impact of the safeguard duty imposed in September?

Tomar: Initially, there was some impact. But the stress is still intense. In my view, the way those countries are behaving, they can continue for another year, year and a half. But the way we are thinking, we may be able to wriggle out of it.

BT: Have you heard of plants being shut or capacity utilisation falling?

Tomar: I have not received any information about any major plants shutting down in the domestic market. I don't think that will happen either. Of course, capacity utilisation has come down, because we are in a slowdown and that has impacted every company, big or small. Demand should increase and we are also in favour of it. We are also trying our level best to do that. At the same time, our industry should also grow and be profitable. Our domestic industry should not be impacted by anything. Public investments planned by the government of India and low base of per capita consumption will be the growth drivers.

BT: Considering the distress right now, do you think there is a need to review the roadmap for the sector including SAIL's own capacity expansion plans?

Tomar: We keep reviewing SAIL's plans from time to time. It is true that even our vision of 300 mtpa and SAIL's 50 mtpa by 2025 should be impacted in the current scenario and we will definitely review this at some point of time. It looks daunting in today's time, but we should not shy away from it. Right now the market is not favourably inclined towards achieving these numbers, but it will not stay like this forever. If we have to achieve the vision of 'Make in India', then demand for steel will obviously go up. We should be able to meet that demand and not fall short.