Are There Any Relative Opportunities in the Steel Industry?

Relative opportunities

The earnings season for 1Q16 is nearly over, and most steel companies have reported their earnings for the quarter. In this series, we’ll explore some of the key highlights of major steel companies’ 1Q16 earnings. Later in the series, we’ll see if there are relative opportunities available in the steel industry.

Roller coaster year

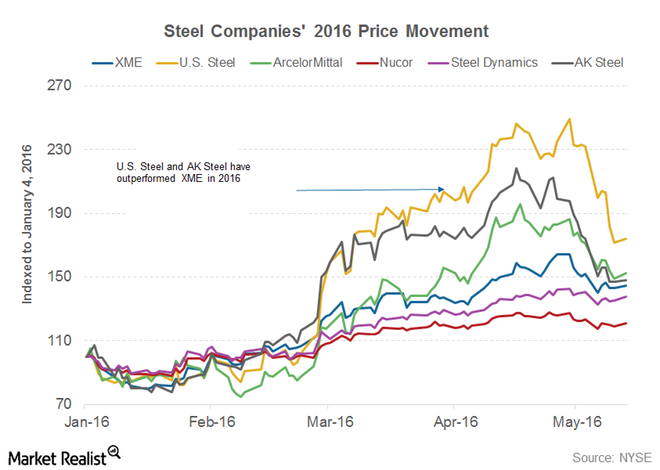

It’s been a roller coaster year for steelmakers, as can be seen in the graph above. 2016 started on a weak note, and commodity companies fell to multiyear lows in January. However, we saw decent upward price action between February and April as concerns over China’s slowdown eased.

Now May is turning out to be a rough month for steel companies such as Commercial Metals Company (CMC) and POSCO (PKX) as concerns over the health of the world’s second-largest economy have resurfaced.

1Q16 earnings

The Market’s reaction to steel companies’ 1Q16 earnings has been lukewarm. Generally, steel companies’ earnings are associated with wild price movements. However, U.S. Steel Corporation (X), ArcelorMittal (MT), and Nucor (NUE) closed almost flat after their respective 1Q16 earnings releases.

Markets (DIA) have largely taken steel companies’ 1Q16 earnings in stride, and the focus has shifted to improving fundamentals.

Although some steel companies managed to beat their consensus earnings estimates, there are various other aspects that Market looks for in quarterly financial results when analyzing a company—for example, steel shipments.