Can Strong Steel Demand Become a Nemesis of US Steel Industry?

Steel demand

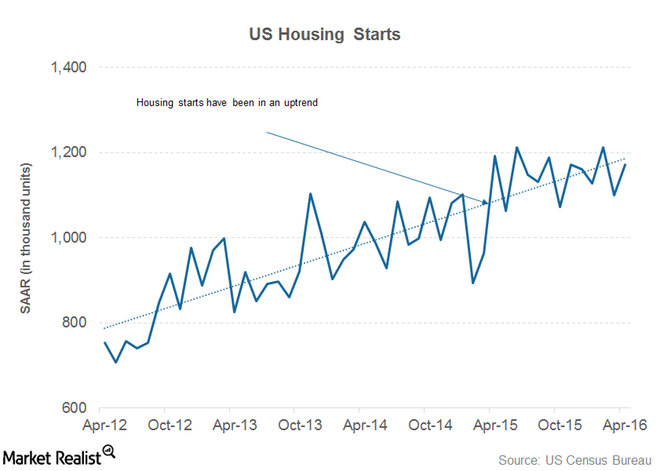

Previously, we looked at some steel demand indicators from the nonresidential construction, energy, and automotive sectors. In this part of the series, we’ll see how the residential housing sector, a major steel consumer, is shaping up this year.

Housing starts rose in April

Building permits and housing starts act as leading indicators of residential construction activity. Housing starts rose by 6.6% to a seasonally adjusted annual rate (or SAAR) of 1.2 million units in April 2016. The data came in better than expected. What’s better, March housing starts were revised upwards to a SAAR of 1.10 million units from the previously reported 1.09 million units.

Building permits fell by 3.6% to 1.1 million units to a SAAR in April. The undertone in the construction industry remains optimistic. Total construction spending surged to an annualized rate of $1.1 trillion in March. This is the highest level of construction spending in the last eight years.

Is it really positive?

On any other day, a strong housing demand would have worked to the advantage of US steel companies. However, strong US (DIA) economic data have again raised expectations of a rate hike by the Fed. The recent hawkish comments from the Fed haven’t helped matters and have fueled a sell-off in commodity shares.

However, on the positive side, better-than-expected steel demand coupled with a clampdown on imports has helped US steel companies such as United States Steel (X), AK Steel (AKS), and Nucor (NUE) raise their base selling prices. We’ll look at the trend in spot steel prices and outlook for 2016 later in this series. But before that, in the next part, we’ll look at the metal service center (RS) activity in April.